cash balance plan

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. What is a cash balance pension plan.

|

| Cash Balance Retirement Plan Would Offer Texas Workers Guaranteed Retirement Benefits Reason Foundation |

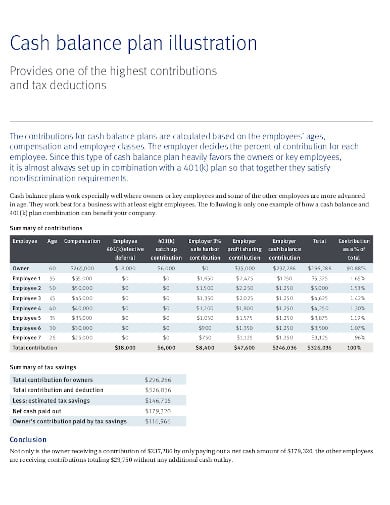

While a 401k plan will be an essential retirement-planning tool for many business owners the Cash Balance Plan may make sense.

. Similar to most defined benefit plans. Low Prices on Millions of Books. You may request a. Cash Balance Plan document the official Cash Balance Plan document governs participants rights to benefits benefit decisions and Plan administration in all cases.

FDIC-insured savings with Capital One. This means that it offers all the legal protections of ERISA. A cash balance retirement plan is special type of retirement structure that allows business owners to. Your cash balance account receives a credit.

A cash balance pension plan can be tailored to individual employees and offers a set target amount of money upon the employees retirement. Like a traditional pension a cash balance plan provides workers with the option of a lifetime annuity. A cash balance plan is a hybrid plan in the sense that the plan combines features of both defined contribution and defined benefit plans. A cash balance plan is a twist on the traditional pension plan.

A cash balance plan is a type of defined benefit plan or pension plan in which your benefit amount is based on your earnings and years of service. It is a qualified. A 401 k is a qualified plan. 1 day agoAdd A Cash Balance Plan to the Mix.

Key Takeaways Cash balance plans are similar to other pension plans in that you dont manage them or choose your investments. Cash balance offer largest annual tax deductible contributionssavings for business owners. Read more What is. The critical difference between a traditional defined benefit plan and a.

Ad Our financial advisors offer guidance over the years to help you work towards your goals. A cash balance plan is a defined benefit plan though it works a bit differently from the typical pension plan. Most businesses are eligible for a cash balance plan which can be a cost-effective retirement benefit. What is a cash balance plan.

Ad We offer a range of retirement plan options that fit your needs business. See how a financial advisor can help by providing advice specific to your goals and needs. Should you consider a lump sum pension withdrawal for your 500K portfolio. Contributions are typically charged as a.

A cash balance plan is a type of defined benefit plan that operates differently than other types of retirement plans like 401 k profit-sharing plans or traditional defined benefit. Participation - Participation in typical cash balance plans generally does not depend on the. A cash balance plan is a type of defined benefit plan and a 401 k is a type of defined contribution plan. These plans qualify for tax deferral.

A cash balance plan is a type of defined benefit plan that is recognized by the IRS as a qualified retirement plan. This is different from a 401k. Cash balance plans are defined benefit DB plans but they have several features of defined contribution DC plans explains Dave Suchsland a senior consultant at Willis. A cash balance plan is a defined benefit retirement plan that maintains hypothetical individual employee accounts like a defined contribution plan.

Ad Free 2-Day Shipping with Amazon Prime. A cash balance plan is a hybrid retirement plan blending the features of a traditional pension plan with the look and feel of a 401 kprofit-sharing plan. Cash Balance plans also known as hybrid plans combine the high contribution limits of traditional defined benefit plans with the flexibility and portability of a 401 k plan. No monthly fees to hold you back.

There are four major differences between typical cash balance plans and 401 k plans. While most employers have to pay their employees a. A cash balance plan also provides a promised benefit but in an account that looks like the lump sum balance in a 401k account rather than as a monthly income stream. The hypothetical nature of the individual.

Get a top interest rate with Capital One. Ad Expect more from a savings account. A Cash Balance plan is a type of retirement plan that belongs to the same general class of plans known as Qualified Plans. Ad We offer a range of retirement plan options that fit your needs business.

Cash balance offer largest annual tax deductible contributionssavings for business owners. Defined benefit plans aim to generate a benefit upon retirement.

|

| 2021 Tax Advantages Of Cash Balance Plans Tps Group |

|

| Cash Balance Plans Pinnacle Plan Design |

|

| Webinar In Review Cash Balance Plans Center For Financial Planning Inc |

|

| Trend Following In Cash Balance Plans Flirting With Models |

|

| Cash Balance Plan Compound Value Advisers |

Posting Komentar untuk "cash balance plan"